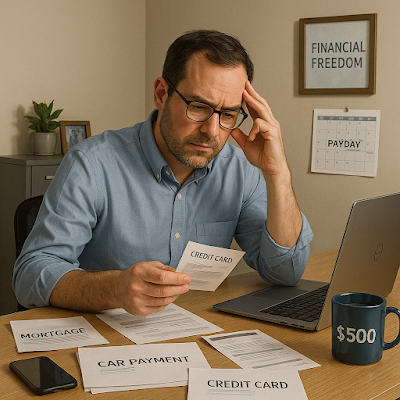

You might assume that earning $100,000 or more automatically buys you financial peace of mind. Yet the truth is starker: 58 percent of Americans describe themselves as “cash poor,” meaning they don’t have enough liquid savings to cover an emergency, even at higher incomes. And a MarketWatch survey from early 2025 shows that over half of households (53 percent) live paycheck to paycheck, a reality that cuts across income brackets. One in seven cash-strapped people earns more than $75,000 a year—so it’s not just lower earners who feel the squeeze.

Consider this: if your household income totals $180,000, with benefits and retirement contributions in place, you’d expect some breathing room. But what happens when sky-high rent and car payments absorb 70 percent of that? According to a 2025 PYMNTS analysis, roughly 50 percent of people making $ 100,000 or more need every paycheck just to break even, and many lean on credit cards or short-term loans to cover gaps. In short, making more money doesn’t guarantee a bigger financial cushion—debt servicing, student loans, and medical bills can eat away at your paycheck faster than you realize.

Consequences of Financial Stress in the Workplace

What happens when you carry that kind of financial weight into your 9-to-5? A 2024 Bank of America survey found that financially stressed employees are 54 percent more likely to be distracted on the job—meaning lower engagement and higher absenteeism. Chronic money worries also fuel anxiety, depression and job dissatisfaction, which in turn drive up turnover and healthcare costs for employers. The American Psychological Association reports that 62 percent of adults say money is a significant source of stress—stress that inevitably bleeds into work performance .

Ask yourself:

Are you too embarrassed to admit you’re stretched thin, even though you earn well?

Have you noticed how lifestyle inflation (that fancy home or new car) secretly sabotages your budget?

Bankrate data shows that 43 percent of credit-card holders earning $100 000 or more carry balances month to month—locking them into high interest rates and diminishing take-home pay over time . As that debt snowball grows, morale plummets and long-term planning becomes a luxury you can’t afford.

That’s where Yolanda Soto—the C.R.E.A.M. Strategist—steps in. She created C.R.E.A.M. Mastery: The $500 Hour Curriculum™ to help organizations tackle financial stress head-on. C.R.E.A.M. stands for Credit, Responsibility, Earnings, Assets and Mindset, and each component frames a question designed to spark real change:

Credit: Are you aware of how your credit score influences loan rates, insurance premiums and job prospects?

Responsibility: What would it feel like to own every financial decision—big or small—with confidence?

Earnings: How can you optimize your income (beyond salary) to build true wealth?

Assets: Which assets (real estate, investments or side hustles) could start working for you today?

Mindset: What beliefs about money are holding you back from reaching your next financial milestone?

By partnering with employers, the C.R.E.A.M. Strategist integrates targeted financial education into workplace-wellness programs, creating a supportive culture where money conversations aren’t taboo.

How the Curriculum Works

One practical module asks employees to map out every recurring expense on a simple spreadsheet and ask: “Can I renegotiate or eliminate this to free up at least $500 a month?” Another lesson dives into spending psychology: “What emotional triggers prompt you to swipe your card, and how can you catch them before you cave?” Remember: 46 percent of high earners cite lifestyle inflation as a major reason they still live paycheck to paycheck . By demonstrating that small shifts—like canceling one subscription or reallocating a dining-out budget—can translate into $500 in monthly savings, employees see immediate traction toward financial stability.

How Employers Benefit from Financial-Wellness Initiatives

When companies invest in employee financial-wellness, the ROI can be eye-opening. A 2024 Employee Financial Impact Study found that businesses offering on-site financial counseling and workshops saw a 35 percent drop in reported financial stress among staff—and a 22 percent boost in productivity metrics within six months . Turnover rates among participants in these programs were 18 percent lower compared with those without such support.

Imagine a mid-sized financial-services firm that integrated C.R.E.A.M. Mastery into its leadership-development track. Managers quickly reported improved team morale—smoother workflows, fewer payroll disputes, because staff members were no longer preoccupied with personal money struggles. Beyond direct cost savings, employers that champion financial education build loyalty and become magnets for top talent. According to a 2025 Glassdoor survey, 67 percent of job seekers say financial-wellness offerings are a “very important” benefit—second only to health insurance .

Investing in Financial Well-Being Pays Dividends

Remember: 32.3 percent of mid-six-figure earners and 20.6 percent of those making over $150 000 admit to living paycheck to paycheck . So here’s my question to you and your leadership team:

What would your workplace look like if every employee felt confident about their finances?

By partnering with Yolanda Soto, the C.R.E.A.M. Strategist, and her proven C.R.E.A.M. Mastery: The $500 Hour Curriculum™, you can reduce financial stress among staff, boost productivity and strengthen retention. Empowering employees to control their money isn’t a “nice-to-have”; it’s a strategic investment in your most valuable asset: your people.

In an era where economic uncertainty looms large, employers who priorities their staff’s fiscal health stand to gain in productivity, loyalty and a competitive edge in attracting talent. What’s stopping you from taking that first step today?